This story was originally published by Yale Environment 360 and is republished here in partnership with Climate Desk .

In Odessa, Texas, workers at a startup called SolarCycle unload trucks full of photovoltaic panels that have just been picked up from commercial solar farms across the United States. They separated the panels from the aluminum frame and electrical box, then fed them to a machine that separated the glass from the laminated materials that have helped generate electricity from sunlight for nearly a quarter of a century.

The slabs are then crushed, ground and subjected to a proprietary process that extracts the precious elements, particularly silver, copper and crystalline silicon. These materials, like aluminum and glass, are sold at a lower cost that can also be used in future generations of solar panels.

The process offers a glimpse into what could happen with the estimated increase in the distance of solar panels, the fastest growing energy source in the United States. Currently, about 90 percent of panels in the US either lose their function with age or become damaged and end up in landfills because these alternatives are cheap.

However, recycling advocates in the US argue that more recycling of valuable materials such as silver and copper will help develop a circular economy in which waste and pollution are reduced through continuous recycling of materials. According to a 2021 report by the National Renewable Energy Laboratory (NREL), recycling photovoltaic panels can reduce the risk of pollution from landfills; increasing supply chain stability, which is heavily dependent on imports from Southeast Asia; reducing raw material costs for diesel and other types of manufacturers; and expanding market opportunities for US processors.

Of course, reusing damaged but working disks is a better option. Millions of these panels now end up in the developing world, while others are recycled closer to home. For example, SolarCycle is building a power plant for its Texas facility that will use upgraded modules.

The prospect of a surplus of obsolete modules in the future is driving a handful of solar power recyclers to try to bridge the gap between the ongoing build-out of renewable energy capacity by utilities, cities and private companies (millions of modules are installed worldwide every year installed ) and scarcity. a facility that can safely process Mayo's material when it reaches the end of its useful life in approximately 25 to 30 years.

According to the latest quarterly report from the Solar Energy Industry Association and consulting firm Wood Mackenzie, solar energy capacity in the United States is expected to grow at an average annual rate of 21 percent between 2023 and 2027. The expected growth is supported by legislation. Reduced inflation through 2022, which includes a 30 percent tax credit for residential solar installations, among other renewable energy subsidies.

NREL estimates the number of solar panels to be installed in the United States in 2021 and removed by 2030 is approximately 3,000 football fields. "It's a fine waste," said Taylor Curtis, legal and regulatory analyst for the lab. But the industry's recycling rate of less than 10 percent is well below the industry's optimistic growth projections.

Jesse Simmons, co-founder of SolarCycle, which employs about 30 people and was founded last December, said landfills typically charge $1 to $2 to preserve solar panels, rising to about $5 if the material is classified as hazardous becomes. . Instead, your company charges $18 per panel. Customers were willing to pay that fee because they couldn't find a landfill approved for hazardous waste acceptance and legal liability, and because they wanted to minimize the environmental impact of their old panels, said Simmons, a former Sierra Club executive. .

SolarCycle provides its customers with an environmental analysis that shows the benefits of recycled modules. For example, the processing of aluminum uses 95 percent less energy than the production of raw aluminum, which involves the costs of extracting the raw material bauxite, then transporting it and refining it.

The company estimates that recycling each panel saves 97 pounds of carbon emissions; This number exceeds 1.5 tons of CO2 if the panels are reused. Under the rules proposed by the Securities and Exchange Commission, listed companies will be required to disclose information about climate-related risks that could have a significant impact on their business, including greenhouse gas emissions.

The aluminum removed from the solar panels at the SolarCycle factory is sold to the nearest scrap yard. Glass currently sells for pennies a module to be reused in essential products like bottles, but Simmons hopes to eventually sell enough of it to new solar film manufacturers to sell at higher prices.

Crystalline silicon, used as the basis for solar cells, is also worth recovering, he said. Although it must be refined for use in future modules, its use avoids the environmental impact of extracting and processing new silicon.

SolarCycle is one of only five companies in the United States certified by SEIA to provide recycling services. According to the US Environmental Protection Agency, the industry is still in its infancy and is still figuring out how to make money from salvaging and selling panel components. "Components from this recycling process may be available in the United States, but have yet to occur on a large scale," states the EPA's Industry Overview.

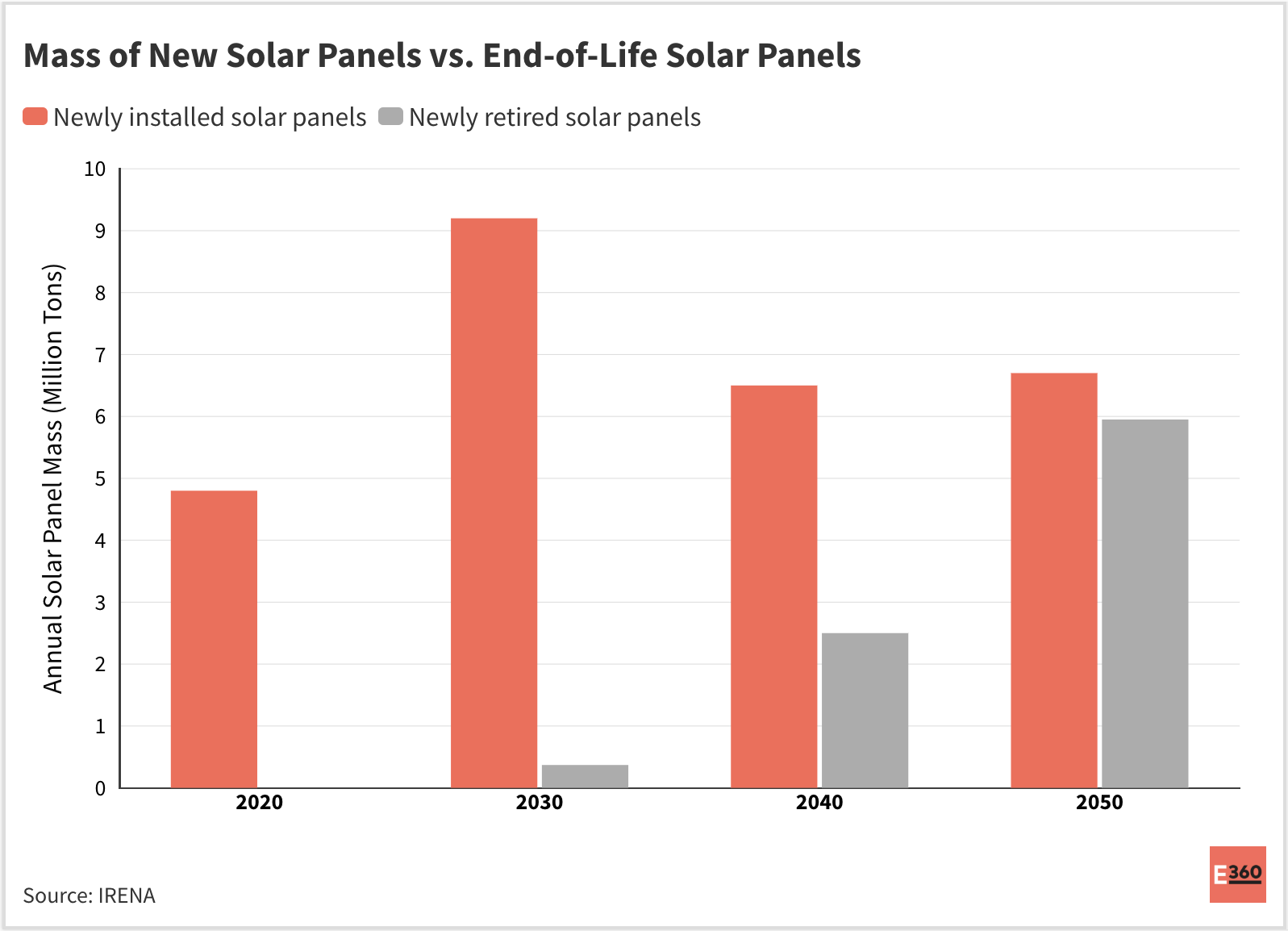

In 2016, the International Renewable Energy Agency (IRENA) estimated that by the early 2030s, the total number of unused PV panels would account for about 4 percent of installed panels. By 2050, the amount of solar panel waste will increase by at least 5 million tons per year, the agency found. China, the world's largest solar producer, is expected to phase out at least 13.5 million tons of solar panels by 2050, the most among the top solar producers and nearly double the United States. According to IRENA's report.

The report notes that the technologically recoverable raw materials from photovoltaic panels could be as high as US$450 million (relative to 2016) by 2030, roughly equivalent to the cost of the raw materials needed to manufacture 60 million new panels, or 18 gigawatts are needed power. . power plants. By 2050, the report says, total spending could top $15 billion.

However, today's solar cell processors face significant economic, technological and regulatory challenges. Part of the problem, says NREL's Curtis, is a lack of data on module recycling rates, which precludes potential counterbalancing measures that could give solar array operators more incentive to recycle modules that have exceeded their useful life.

Another issue is the toxicity profile leaching method, an EPA-approved method used to determine if a product or ingredient contains a hazardous substance that can be released into the environment and is known to be defective. As a result, some solar farm owners are "over-regulating" their panels without a formal definition of hazardous waste, Curtis said. They pay more to have their hazardous waste disposed of in an approved landfill or recycled.

The International Energy Agency has assessed whether solar panels containing lead, cadmium and selenium could affect human health if disposed of in hazardous landfills or municipal landfills and found the risk to be low. However, the agency said in a 2020 report that its findings were not an endorsement of landfill: recycling would "further reduce" environmental problems.

NREL is currently investigating alternative methods to determine if panels are unsafe. "We need to figure it out because it definitely impacts liability and costs to make recycling more competitive," Curtis said.

Despite these uncertainties, four states have recently passed PV module recycling laws. California, home of most solar arrays, allows modules to be stockpiled, but only after they've been certified harmless by a specialized lab, which can cost upwards of $1,500. As of July 2022, only one recycling facility in California will accept solar panels.

Washington State will pass legislation in July 2025 that aims to provide an environmentally friendly way to recycle photovoltaic panels; New Jersey state officials hope to release a PV waste management report this spring; And North Carolina has directed the state Environmental Protection Agency to consider closing large solar projects. (North Carolina currently requires that solar panels be disposed of as hazardous waste if they contain silver or, in the case of older panels, heavy metals such as hexavalent chromium, lead, cadmium, and arsenic.)

In the European Union, end-of-life photovoltaic modules have been treated as electronic waste under the EU Waste Electrical and Electronic Equipment (WEEE) Directive since 2012. The directive requires all member states to meet minimum standards, but actual e-waste recycling rates vary from country to country, said Marius Mordal Bakke, senior research analyst for solar energy providers at Rystad Energy, based in Oslo, Norway. . Despite those laws, EU PV power recycling rates are no better than the US at about 10 percent, largely due to the difficulty of extracting the valuable material from the modules, Bakke said.

However, he predicts that as the number of end-of-life modules increases, recycling will become more common until it becomes a business opportunity that yields a valuable material that can be sold to recyclers. Governments can help accelerate this transition, he added, by banning the disposal of photovoltaic panels in landfills and by offering incentives such as tax breaks to anyone using solar panels.

"At some point, so many records will be thrown away that you have to start recycling," says Bucke. "It will be profitable by itself, regardless of the price of the product."