PV magazine from 23/12 to 24/01

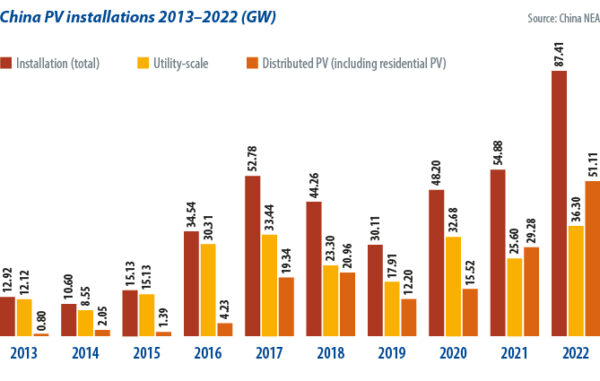

According to data from the National Energy Administration (NEA), China will add an additional 180 GW of solar capacity in 2023 and could exceed 200 GW, reaching approximately 143 GW of solar capacity at the end of October 2023. 2022 is an annual increase from 106% to 129%, and all solar eclipses have been added from 2020 to 2022.

Speaking at a PV conference in early 2023, Wang Bohua, honorary secretary of trade body China Photovoltaic Industry Association (CPIA), predicted 95 GW to 120 GW of installations by 2023. ). At the SNEC PV show in Shanghai in May, executives from primary and secondary module manufacturers told PV Magazine that the annual installation estimate has risen to more than 160 gigawatts.

CPIA revised its figure in July from 120 GW to 140 GW, while S&P Global and government body China Electricity Council raised it to 170 GW in October. In November, market research firm TrendForce predicted that China would produce between 194 and 210 gigawatts of solar power by 2023.

Guided by China's "30-60" goals to achieve peak emissions by 2030 and zero emissions by 2060, the country's state-owned energy companies have pledged to deploy 350 GW of solar capacity. In the first half of 2023, companies signed more than 80 GW of large-scale solar investment contracts. At the end of September 2023, about 61.8 GW were connected.

The pandemic halted the installation of small "distributed" solar panels until the end of 2022, but China recovered with 34.1 GW of distributed commercial and industrial (C&I) systems installed by the end of September 2023. Residential solar policy, cheaper new products and Growth demand has led to 33 GW of solar capacity by the end of September 2023, up 30.5% from 2022, and more than 1.5 million new customers choosing to “go solar”.

The cost of the panel

Those numbers rose after two years of falling panel prices that spurred the development of solar power plants. In 2022, polycrylic prices rose from 80 yuan (US$11.24) per kg to 300 yuan per kg, and panel prices rose to 2 yuan per watt of production capacity. The price of solar glass also increased in 2021 and 2022.

However, a massive expansion of solar generating capacity by the end of 2022 pushed panel prices to around RMB 1.9/W in January 2023, from RMB 1.7/W in March 2023 and RMB 1.3/W in project rates . level W. Module manufacturer in July 2023. The price of 1.18 yuan/W was proposed for procurement by state-owned enterprises in July 2023. In November 2023, the State Energy Investment Corporation and China's Huadian Corporation canceled the procurement. A RMB 1.01/W offer for JinkoSolar's negatively doped "N-type" panels and certain Passive Emitter Reverse Contact (PERC) products at RMB 1/W. They can raise prices by 45% by 2023.

Analysts estimate the cost will be between RMB 1/W and RMB 1.1/W for major module manufacturers. Liu Yuxi, president of Longyi Green Energy's China regional unit, said at a recent conference: "If the price of PV panels falls below 1 yuan/W, it means a complete reduction below the consumption threshold."

Excess capacity

With China's current excess solar generation capacity falling 30-60% below the government's carbon commitments, major players are expanding in anticipation of future market growth.

An estimated 2.5 trillion solar power expansion plans have been announced since 2020, with commitments of 700 billion yuan in 2021 and 900 billion yuan in 2022. 300 billion yuan in manufacturing investment. Between 2020 and 2022, polycrylic production will reach more than 700 billion yuan, and mass production and solar core will exceed 290 billion yuan. Investment in cell and panel manufacturing increased to 820 billion yuan over the period, while solar crystals attracted 110 billion yuan; Production of ethylene vinyl acetate and polyolefin films 18.5 billion yuan; diamond wire cutting equipment 14 billion yuan; And the issue of back sheets is 20 billion yuan.

Data from the CPIA and the silicon division of the China Nonferrous Metals Industry Association show that China will reach an annual production capacity of 30 million tons plus 800 GW of production lines by 2023. module factories. . . Oversupply means plant utilization could be lower than in 2022.

Differences of opinion between companies and governments are evident on the problem of excess capacity. Longyear Liu believes that the current overcapacity is starting to limit the innovation potential of Chinese PV companies. This is due to low selling prices as a result of excess capacity, which reduces the company's profitability and available funds for research and development.

On the other hand, CPIA Deputy Secretary General Liu Yang believes that excess capacity is an inevitable phenomenon in a market economy. He said the problem was the structural aspect of overcapacity and said it was important to recognize that market economies inherently have overcapacity due to competition.

An official from China's Ministry of Industry and Information Technology said China's photovoltaic industry is operating normally. The official said that excess capacity is a common phenomenon in market competition.

The stock market reacted violently to both forecasts. In 2023, China's photo stock prices fell steadily, with shares of many major solar companies falling 50% or more. This drop shows that investors are very concerned about the profitability of the sector.

New technology

Huge investments were made not only to increase production capacity, but also to intensify scientific research and development of new technologies. During 2023, many new technologies were introduced into production processes.

Polysilicon producer GCL, for example, has invested heavily in expanding granular silicon production capacity, calling its product the more economical and consistent second-generation polysilicon. Lan Tianshi, one of the CEOs of GCL Technology, told the media that the price of polysilicon granules produced at GCL's Leshan plant was lower than 36 yuan per kg. This significant cost advantage makes GCL a unique competitor in the polycrylic price war.

The high price of polycrylic in 2022 has prompted wafer manufacturers to explore various methods of thin wafers and lower material costs. Companies such as Longyi, TCL Zhonghuan and Gaos have had great success in thinning silicon wafers to less than 150 micrometers for passive oxide contact tunneling (TOPCon) solar cells, with even thinner wafers between 90 micrometers and 100 micrometers thick. (HJT). These advances have significantly reduced the cost of using polycrylic.

Mobile storage

The most significant technological progress has been seen in the field of solar cells. As the efficiency of PERC cells approaches theoretical limits, manufacturers are turning to next-generation cell technology. Different perceptions of technologies and markets have led to different choices among manufacturers.

Leading panel manufacturers such as JinkoSolar are attracted to TOPCon's technologies, which enable continuous improvement of the extensive PERC production lines. Jinko recently said that TOPCon generation capacity reached an impressive 55 GW by the end of June 2023, and TopCon N-type generation capacity is expected to account for more than 75% of its capacity by the end of 2023. 110 GW. .

This rapid modernization of the production lines depends on the rapid market acceptance of Topcon's N-type products. In the first half of the year, Jinko's N-type products already accounted for more than half of the 30.8 GW of shipments of N-type modules and N-type products. 2023 year.

HJT technology is also experiencing rapid market penetration. Huasun, a new player in the panel industry, expects to reach 15 GW of HJT cells and modules by the end of 2023, with plans for an additional 20 GW of new capacity.

Leading panel maker Risen is betting that HJT will reach 15 gigawatts of cell and module capacity by the end of 2023. Together with other companies investing in HJT, about 70 GW of additional cell and module capacity could go into production. By the end of 2023. This indicates that a large number of HJT modules will enter the market in 2024.

Longi and Ico Solar are actively promoting a variety of back cell (xBC) technologies, with Longi demonstrating its hybrid passive feedback and Ico focusing on a full feedback approach. Given the dominance of the two companies in the industry, xBC cell technology is expected to develop significantly in 2024. The combination of TOPCon, HJT and xBC cells will replace PERC technology, accelerating its exit from the market.

A major development was that in June, most Chinese panel manufacturers came together to create a standard size for medium-format PV panels, ending the practice of custom sizes. The uniform dimensions of the panels not only facilitate the processes of transportation and storage, but also help to reduce costs in the industry.

New scenario

In China, large-scale photovoltaics are mainly operated by state-owned power companies. The limited availability of land in eastern and southern China places large-scale power plants mainly in the mountainous desert areas of the north and northwest. However, countries face the problem of electricity consumption.

To combat this phenomenon, the Chinese government plans to build very high voltage transmission lines to transport electricity generated in economically developed regions in the central and eastern parts of the country.

According to the 14th Plan of the National Five-Year Plan, China intends to establish large-scale renewable energy bases in nine regions in the west, north and northwest by 2030. The goal is to install at least 450 GW of renewable energy capacity, mostly solar. wind zones In 2021, the state energy companies authorized the first group of projects with a capacity of 97 GW. After 2023, the construction of the second group will begin, which will be more than 400 GW. The 100 GW projects are expected to be completed during the 14th five-year period ending in 2025.

These large-scale power bases, managed by the National Development and Reform Commission and the KTA, play different roles. In addition to providing high-capacity renewable energy facilities for clean energy production, they also serve as testing grounds for new modular products.

The approach is similar to the government's previous Top Runner program, but the new utility-scale energy bases could test methods for reducing grid power surges, green hydrogen production, combating desertification, agro-electricity, "photoelectric pastures" and even "advanced" manufacturing. . measurement. energy storage Installations with coal "to improve the quality of energy.

In addition to developing power plants, state-owned energy companies have found new applications for solar technology, such as highways and marine photovoltaics.

An innovative application

The implementation of the road photovoltaic system includes the placement of distributed photovoltaic parks on the roofs of buildings in the service areas of the highway, in parking lots and on the road surface near the service areas. This power generation system can provide clean electricity to serve passengers and vehicles. Several government agencies have also requested the installation of a photovoltaic system in the middle of the freeway buffer zone and on the soundproof walls on both sides. Although there are technical and financial difficulties. Some local authorities have initiated research and formulated specifications and supporting policies. The future of roadside solar has great potential and is expected to gain momentum.

Offshore PVOs are on the rise. According to China's Ministry of Natural Resources, the country boasts a large area of approximately 710,000 km2 designated for the installation of marine PV systems, covering more than 70 GHz of floating PV capacity. Coastal provinces such as Shandong, Jiangsu and Jiajiang have presented ambitious plans to develop offshore PV around 60 GHz.

Although the current cost of floating solar is 5-12% higher than land-based PV, lower module prices have allowed offshore PV investments to benefit from a positive return on investment. Hyang Hg 34 factory installed in November 2023 with impressive production capacity

2.7 gigawatts started working on the coast of Shandong province. The growth of offshore PV still faces obstacles, such as the lack of policy support and the risk of climate change.

Option for 2024

By 2024, China's PV industry will need to focus on several key areas. First, the sector is concerned about the price of the PV module. Faced with the twin pressures of production capacity and falling demand, the price of modules may fall further. As of November 2023, unconfirmed reports suggest that Tear One wafer, cell and module manufacturers are facing more frequent production and production cuts to maintain prices and margins. This is done to see if limited production can stabilize or increase the price of the module.

Second, China's PV supply chain is oversupplied at all nodes. New production facilities are expected in 2023 and 2024. Excess capacity can lead to serious damage, failure and restructuring of many initiatives. It remains to be seen whether the major solar manufacturers will face the same problem as Santec, English and LDK.

China's economy is facing a slowdown, production is halting or shrinking, and demand for electricity is expected to stagnate or decline. From the perspective of low costs and profits, investors in power plants can significantly reduce their appetite. A reduction in installed capacity could lead to a slowdown in industry growth.

The first concern in 2024 is how much new solar generating capacity can be expected. Reliance on renewables has raised concerns about grid stability.

As of October 2023, some provincial governments in China have temporarily suspended the approval of onshore or distributed PV projects. These decisions stem from the concern that the grids will not be able to obtain energy from nonsensical sources. How will the situation improve in 2024? Otherwise, it will definitely have a big impact on the new solar energy. In fact, annual new PV capacity may decline in 2024.

What is certain is that topcone is on its way to becoming a mainstream product. The market space for HJT and XBC cells, however, remains uncertain, and the possibility of commercial progress with Perovsky is still on the back burner.

Regardless of the global context, China's 30-60 carbon targets protect the long-term trajectory of the PV industry. Although short-term risks may arise, art will inevitably experience a renaissance.

This content is copyrighted and may not be reused. If you would like to collaborate with us and reuse some of our content, please contact: editors@pv-magazine.com.